Chapter 26: Why EVelution Energy’s Critical Mineral Project Offers Lower Risk for EB-5 Investors

Sergio Chávez-Moreno explains how government policy, expert management, and strategic guarantees make EVelution Energy a stable EB-5 opportunity.

In Chapter 26 of our continuing interview series, Michael Gibson, Managing Director of USAdvisors.org, speaks with Sergio Chávez-Moreno, Operating Partner at Intermestic Capital, about a key question on the minds of many EB-5 investors: Is a commodity-based project too risky?

Sergio’s answer is clear — the EVelution Energy cobalt processing facility is not only well-positioned within a critical minerals sector that enjoys strong federal policy support, but also features multiple safeguards that make it a stable, high-quality EB-5 investment.

He notes:

National Policy Priority: Cobalt is recognized as a critical mineral essential to U.S. manufacturing and energy independence.

Government Financing Alignment: The EVelution Energy team has signed an LOI with the U.S. Export-Import Bank — a strong sign of federal commitment.

Investor Protection: Intermestic Capital has structured the investment to include strategic guarantees and risk mitigation.

Together, these elements create a compelling EB-5 investment opportunity that aligns with U.S. policy, industry demand, and investor security.

🎥 Watch Chapter 26 on YouTube to learn more from Sergio Chávez-Moreno and explore previous chapters in the series.

Evelution Energy Interview Chapter 25

Michael Gibson, USAdvisors, interviews Dennis Cunninbgham, Operating Partner Intermestic Capital, President EB5 Horizon

Transcript

EVelution Energy Interview Chapter 26 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson, speaking

Sergio, there was a, I guess interest from the market into this kind of an asset class. Typically, people might shy away from commodities because the, the volatile nature. We all know, I mean we're talking about the price of eggs right now.

Dennis Cunningham, speaking

Yeah.

Michael Gibson, speaking

Oil, the gas price, when you go fill up at the pump. It seems to me, that people, traditionally, would migrate to the construction projects. Because that's something they understand, home ownership, or multi family, or checking into a hotel. This, on the surface, might seem to be risky. Although, as I did mention in the interview with Gil and Navaid, that they described how their risk mitigation techniques. What would you say to an EB5, a potential EB5 Investor about how this project, although it involves a commodity process, why they should consider it to be less risky than, perhaps even a commercial real estate investment.

Sergio Chavez-Moreno, speaking

Yes. Well, firstly it is a policy priority. It is a critical mineral. And the, and President Trump's administration has been very clear, that he will prioritize this commodity. Right. So off, off of that, they're investing in a project with a lot of political support. The, the, the, EVelution team did sign an LOI to obtain financing from the Import Export Bank. Which is, which is a sign of commitment from the US government. Right. Second, as a Manager, as a Fund Manager, we hired the best, the top experts in the EB5 industry. Who we talk to on a daily basis. Right and thirdly we did obtain very strategic guarantees from the EVelution team early on.

EVelution Energy Interview Chapter 25: EB-5 Investor Exit Strategy: Multiple Paths to Repayment at EVelution Energy

Dennis Cunningham explains how operating strength and financial structure support investor repayment options in the EVelution Energy project.

In Chapter 25 of the EVelution Energy Interview Series, Michael Gibson, Managing Director of USAdvisors.org, speaks with Dennis Cunningham, President of EB5 Horizon and Operating Partner at Intermestic Capital, about a key question for every EB-5 investor: What is the exit strategy?

Dennis shares that the EVelution Energy cobalt processing project in Yuma County, Arizona has a diversified repayment plan built on the project’s operational success and capital structure.

“There are several options open,” Dennis explains. “We’re working closely with our partners at EVelution Energy on operating cash flow, refinancing part of the debt, and potential sales strategies. The key point is that we’re sponsoring a strong, profitable business — that’s what makes repayment possible.”

With operating margins in the 20–25% range and EB-5 debt representing about 28–30% of the total capital stack, the project’s financial foundation provides flexibility and confidence for investors expecting a return after their five-year commitment.

Evelution Energy Interview Chapter 25

Michael Gibson, USAdvisors, interviews Dennis Cunninbgham, Operating Partner Intermestic Capital, President EB5 Horizon

Transcript

EVelution Energy Interview Chapter 25 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson, speaking

So Dennis, we talked about job creation. You're 4X, using everybody, using the, the operational, using the construction, the direct, indirect, and induced. 4X. If you take even, I guess as, as I understand, it you just take the operational out.

Dennis Cunningham, speaking

Yep.

Michael Gibson, speaking

And you only rely on construction. Which will be done in two years. Which again in, in a, in a commercial real estate sense, is very fast. And stabilized on day one. As we said, we've, we've heard all the sales are accounted for. That's two years. So we, we talked about the job creation. We talked about the timeline for the, for the project to be operational. We talked about the ROI, the projected ROI. One thing we haven't talked, the exit strategy. So client is in, the Investor is in for five years. How do they expect to get their money back? What is, what is the signature event? Or is there an event? How does it work? So that there will be some sort of a payout at the end of the five years.

Dennis Cunningham, speaking

So there's several options open. And we're working closely with our partners at EV, Navaid and Gil. There's operating cash flow. There is a refi of part of the debt. There is a sales strategy. There's a numerous strategies. But the key point is, you've got first in class, you've got baked in operating margins. That when they listen to the video, they will hear they're in the, very healthy 15% 20%, excuse me, 20% 25% range. That provides the vehicle to take out the EB5 debt. Which is about 28% to 30% of the capital stack. So, exactly what form that's gonna take, bnwe don't know. But it's gonna be one of those three forms, that will allow us to provide the exit strategy for the EB5 Investor. The key point is, do we have a good operating business? That's making money? By signing the on take and the off take, and negotiating those contracts, negotiating those LOIs, being in negotiations with those types of firms, yes. We're, we are sponsoring a great operating business. That's the key point.

EVelution Energy Interview Chapter 24: Timing Matters for EB-5 Investors

Marco Lopez on the importance of early participation in the 9% return offering

Chapter 24 of our EB-5 interview series features Michael Gibson in conversation with Marco Lopez, Managing Partner of Intermestic Capital.

In this chapter, they discuss the importance of timing for EB-5 investors:

Early investors are currently offered a 9% projected return.

Intermestic Capital may revise terms once Expedite approval is secured.

Acting early ensures access to the most favorable terms.

As Marco Lopez explains:

“It’s good to bring first, loyal partners on board. They have the opportunity to benefit a little bit more than that 30th investor.”

Evelution Energy Interview Chapter 24

Michael Gibson, USAdvisors, interviews Marco Lopez, Managing Partner, Intermestic Capital

Transcript

EVelution Energy Interview Chapter 24 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson, speaking

So, again, back to you and Marco. Let me, let me ask you. So, assuming, right now you start off with a 9% offering. In, in the... Because you don't know if you'll get the Expedite. There's a, I would say, a better than fair chance that you will. But let's say initially, for any investor who's looking, who is interested in subscribing, they, they would as they subscribe, they would be entitled, entitled to the 9%. Do you foresee that changing? And if so, when? And how? And by how much?

Marco Lopez, speaking

Look, I think, if they are listening to this video now, and they are looking to make a decision, I encourage them to do and make a decision ASAP. Because I've not sat down with the team and decided when our cut off is gonna be. But there will be a cut off. Because I think it's good to bring first, loyal partners on board. And they have the opportunity to benefit, a little bit more than that 30th investor. That kind of piled on and said okay, well I'm gonna be in it too.

Michael Gibson, speaking

Once they have the assurance that you have the expedite.

Marco Lopez, speaking

Yeah. Look, we haven't made that decision Michael. But it's certainly something that we've thought about. It's too early to…. Let's get everyone who's hesitant in the door now. And hopefully we don't have to make this decision.

EVelution Energy Interview Chapter 23: Projected EB5 Investor Returns

Chapter 23 of our interview series features a powerful discussion between Michael Gibson (USAdvisors.org), Sergio Chavez-Moreno, and Marco Lopez of Intermestic Capital.

In this conversation, Sergio and Marco outline why EVelution Energy offers a projected 9% rate of return to EB-5 investors and why quarterly payments reinforce transparency and trust.

Marco emphasizes the importance of fairness in EB-5:

“For us it’s about fairness. It’s about feeling good. And it’s about partnership. Everyone participates, and everyone wins in a stellar project.”

This chapter underscores how EVelution Energy stands out as a best-in-class project built on transparency, investor confidence, and strong fundamentals.

Evelution Energy Interview Chapter 23

Michael Gibson, USAdvisors, interviews Marco Lopez, Managing Partner, Intermestic Capital, Sergio Chavez-Moreo, Operating Partner, Intermestic Capital

Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson, speaking

So, Sergio, just to be clear. Because we, we do have potential investors who are looking, and their attorneys. We work with the, the immigration attorneys. We work with tax advisors and family offices. And, and there some I, I guarantee, people are gonna be asking, what is the projected rate of return? Because you can't guarantee it, but you can project. What are you offering investors who invest now? And how might that change should you get the expedite approval?

Sergio Chavez-Moreno, speaking

So, right now we are offering investors a 9% rate of return. And let me explain why. Here at, at a Intermestic, we're about people. Right. You know, we become really close to our partners at EVelution. And we share their, their vision. And we want to, to extend this offering and this opportunity to our investors with that same, same vision. And, well, since EVelution is the "Best in Class" project, a great team. We also wanna play on their standards. Right. And really bring a high rate of return that merits an investment in this great project.

Marco Lopez, speaking

Yeah, this is one of those "Win Win" projects Michael. And I, we wanna make sure that our investors feel good about the project. That they have a, a very solid return paid to them quarterly, during those five years. For us it's about fairness. It's about feeling good. And it's about partnership. I think, I've seen and I've been in conversations where people have invested in a Miami project, very sexy. And they've been sitting there for five years. Haven't received any information. Haven't received their residency. And they're in limbo. That's not, what I think, that damages the entire industry. And that's not what we believe in. We believe in treating people well, fairness and everyone participating. And, and winning in, in a stellar project.

Chapter 22: Marco Lopez: EB-5 Residency Approvals Could Drop to Under Four Months

In Chapter 22 of our interview series, Michael Gibson speaks with Marco Lopez, Managing Partner of Intermestic Capital, about EB-5 processing times for the EVelution Energy cobalt project in Arizona.

According to Lopez, EB-5 investors could expect residency approvals in under 7 months due to the project’s location in a rural/high unemployment area. With the added benefit of a national security designation, those processing times could fall to under 4 months.

“With this added layer of national security interest, I think that knocks it down to under four months.” – Marco Lopez

Lopez emphasized why the project has received strong support from U.S. Senators, local mayors, and federal stakeholders alike.

Evelution Energy Interview Chapter 22

Michael Gibson, USAdvisors, interviews Marco Lopez, Managing Partner, Intermestic Capital

Transcript

EVelution Energy Interview Chapter 22 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson, speaking

So, Marco to pick up from where Dennis left off. For viewers who may not be familiar with processing times, and you were, you were in the heart of that world. You know in your past life in the government. Can you explain, on average, what do you think the processing times could look like without the expedite? And then perhaps, if you do get the expedite, what that may change to?

Marco Lopez, speaking

Yeah, so look, quite simply with without the expedite, because it's in rural Arizona, and a designated High Unemployment Area as well, we would be seeing a return in getting their residency in under seven months. Seven months. Cap let's, let's say. With this added layer of national security interest, I think that knocks it down to under four months.

Michael Gibson, speaking

So you're saying that it, theoretically, again the government being the government, you never know processing times. It could it could be here, one month could be there. Especially if they do, as they, as some people fear, they may shorten the staffing at Homeland Security. We don't know. But, based on current estimates right now, you're saying that the processing time may go down by as much as half.

Marco Lopez, speaking

Absolutely. I think there's no doubt in my mind that once we have that national security interest confirmed. Because if, if you know how that works, is they don't you're, you're, you're good until you're not good. So your your project is confirmed until otherwise notified. And so we expect not to be notified that we're not a national interest project. And if that's the case, we expect that those, that processing would, would be done in under four months. Obviously I'm not Donald Trump, as you can tell. But, I think that he will have people at Homeland Security and USCIS, especially in projects that fulfill his vision of creating jobs in America.

Michael Gibson, speaking

He may actually, he may actually add staff to to increase the processing.

Marco Lopez, speaking

That's correct. That's what we believe, it is likely to be the scenario, that occurs. Because you're creating good old American jobs in an area that needs them, wants them, and, and is embracing this project.

Michael Gibson, speaking

And if his best friends, is all his tech bros, and all of his best friends are manu... they need it in, in manufacturing industries. Like Tesla, and, and whoever, the DOD, they need cobalt. They need processed cobalt. And if there's a plant in the United States that's making it, manufacturing. I could see a tremendous amount of interest to get those applications processed.

Marco Lopez, speaking

No doubt. And, and I think that, that's the case, and that's the point that we're making to the Administration. And why EVelution has been so supported by all of these government officials. As I mentioned before, from our US Senators down to our local Mayors. Because of the importance that this project represents.

Chapter 21: EVelution Energy Interview Series – Investor Returns & Priority Processing

In Chapter 21 of our ongoing EVelution Energy interview series, Michael Gibson, Managing Director of USAdvisors.org, speaks with Dennis Cunningham, Operating Partner at Intermestic Capital and President of EB5 Horizon.

Dennis explains how the project stands apart from typical EB-5 offerings by:

Offering investors a real rate of return

Building safeguards through aligned contracts that help ensure repayment capability

Pursuing priority processing with USCIS, which could dramatically shorten investor wait times

“We want EB-5 investors to see that this project not only secures their green card — it also provides a real return and the potential for priority USCIS processing.” – Dennis Cunningham

#EB5 #EB5Investors #EVelutionEnergy #IntermesticCapital #EB5Horizon

Evelution Energy Interview Chapter 21

Michael Gibson, USAdvisors, interviews Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Transcript

EVelution Energy Interview Chapter 21 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson,

Okay. Now the term, as I understand it, is five years. That's a five year commitment, which is fairly standard in the industry. But you're offering, and I'll leave this collectively to the group, to talk about a rate of return. An ROI, which is I've honestly never heard of before. And I want you to talk about that. Why did you choose? How may that change in the future? Because there are some things that you're working on, the immigration side. So, I know investors and, and I'm a former Citi banker. Return is, is a huge a deal for us in the investment world, in the private equity world. EB5 not so much. We're more concerned about getting the green card. Getting our family in here. Making sure we have an unconditional green card. But in your case, this does offer a real rate of return. So, maybe Dennis, I can start with you and then kick it to these guys.

Dennis Cunningham,

Sure. Thanks, Mike. That's a that's a great question. One of the things that was attracted us to this project not only the strategic part of it that EV offers, and, and the people that are involved there. But when we understood their approach. That they were gonna sign their on take agreements. And orders of the products that we're buying, and their off take agreements. The product that we're selling. In the same month off the same index. We understood that they were trying to bake in their margin. And that margin provided us the comfort to have the, the, the, the feeling that, that, that they would be able to perform and repay the guarantee. They also came to us and said, hey look, this is a first class project. And we want to encourage the EB5 Investor who, who understands hotels, cause they've heard 100 hotel pitches, or condo pitches, or multi family use pitches. We want to incentivize them to take the time to understand what we're doing. Because we're not like everybody else. And reward that time that they're investing up front to understand it. The other thing that's I think important to understand is that as part of the Strategic Metals and Materials Initiative, that are in the national security interest. We can apply for "priority processing" with USCIS. Which is the highest and quickest turnaround. We've retained an attorney who is in the, in the process of providing that application to USCIS. He has 100% success rate in this type of application, with this material, cobalt processing plant. And we believe we'll get that approval. When we get that approval, then it's up to the project sponsors, to determine whether or not they want to modify that rate of return for anybody who signs up after. Which shortens your processing time dramatically.

Chapter 20: nvestor Protections in Focus: Intermestic Capital Safeguards for EB-5 Participants

In Chapter 20 of our ongoing interview series, Michael Gibson sits down with Sergio Chavez-Moreno and Dennis Cunningham to discuss how Intermestic Capital and EB5 Horizon are addressing one of the biggest concerns in EB-5 investing: risk.

Sergio explains the construction guarantee and investor application denial guarantee, designed to protect investor capital. Dennis details how replacement investors can be solicited on behalf of any participant whose I-526E petition is denied.

These safeguards, combined with the strong fundamentals of the EVelution Energy cobalt project, set a new standard for transparency and investor-first structuring.

Evelution Energy Interview Chapter 20

Michael Gibson, USAdvisors, interviews Sergio Chavez-Moreno, Operating Partner Intermestic Capital, Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Transcript

EVelution Energy Interview Chapter 20 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Well, not, not only in Arizona, but across the country the EB5 landscape is, is scattered with failed projects. Talking about risk Sergio, so, when I interviewed with Gill and Navaid, we did talk a lot about market risk. And how they were able to mitigate that through the exercising of contracts in the future, forward contracts for their output. As well as for their inputs. Now in EB5 has a certain number of other risks that are in addition to the market risk. I know you guys, in your offering, have done some things to try to allay the concern. And, and you know, let's be honest, there is a concern in the market. Intermestic is a newer player. This is your first EB5. Dennis, not your first EB5 project. But this is the first as a group. And, so there may be some concern from EB5 investors, who may be unfamiliar with your investment philosophy, your background. But you have done some things to try to allay those fears. Some concerns regarding job creation and the completion of the project. Could you outline those for the investors?

Sergio Chavez-Moreno, speaking

Yes. So as we diligence with the project, with our partners at EVelution, I, we did obtain guarantees, to protect and safeguard our investors interests. Amongst them a construction guarantee, that we did obtain from the project. And an investor application denial guarantee. And, and again just to be sure. So if I'm an investor I file a 526E, and it gets rejected, for a reason that did not have to do with fraud, or anything like that. How, how would the the repayment of the principal work. So, well, so first we will talk to, well the investor and find out what exactly, like, happened . And we will work with them depending on their, well on their circumstance. But we do offer, like a pathway to recuperate some of that investment. And then, yes.

Dennis Cunningham, speaking

We will solicit a replacement investor on their behalf. Right. All that's fully explained in the offering documents, along with the with those other guarantees. But we'll, we'll solicit a replacement investor.

Chapter 19: Marco Lopez on Intermestic Capital’s EB-5 Investment Philosophy

In this chapter of our exclusive interview series, Michael Gibson speaks with Marco Lopez, Managing Partner at Intermestic Capital, about how his firm approaches EB-5 projects differently.

Lopez highlights that while EB-5 requires job creation, Intermestic goes beyond the minimum—ensuring that projects make sense economically and provide investors with strong safeguards.

“The American dream is only attainable if investors find a project with these types of safeguards, with people around them with the passion and the commitment to make sure that success is achieved with them.” – Marco Lopez

With over 3,300 jobs created (more than four times what is required), the EVelution Energy cobalt project stands out as a secure, economically viable, and socially impactful EB-5 investment.

Evelution Energy Interview Chapter 19

Michael Gibson, USAdvisors, interviews Marco Lopez, Managing Partner Intermestic Capital

Transcript

EVelution Energy Interview Chapter 19 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson, speaking

Yeah and, and what, what fascinates me about Intermestic is that, I mean even though this is your first EB5 project, you, you are a capital firm. You, you focus on risk. You focus on how does the investor do well in, in investing in other projects, that you may be associated with. So you, from what I understand, you're taking the same philosophy of trying to find projects that make good sense economically. And now you're bringing it to an EB5. So we have the job creation component. But then in addition, you want to make sure that the project makes sense economically.

Marco Lopez, speaking

That's right. So look, in this particular case we know that the job, that the, the project is going to create over 3,300 jobs. And we're not, we're not gonna need those jobs, to justify our project.

Michael Gibson, speaking

The excess, you have at least a 4X excess margin.

Marco Lopez, speaking

That’s right. So that's the type of thinking that went into our selection of this project. Because we want to provide the investor that guarantee. That, it's my 25 years in government service on the line. It's their reputations and, and expertise and knowledge on the line, from their careers as well. And it's also the reputation and careers of our development partners. That, obviously you, you, you interviewed as well. The stakes are high. And in this world, where people can select multiple projects, where they wanna invest their funds. The American dream is only attainable, if they find a project with these types of safeguards, with people around them with the passion, the commitment, to make sure that success is achieved with them. Because we've seen so many projects, unfortunately here in Arizona, that have not fulfilled the promise, that they've set out to, the value that they've set out to create for their investors.

Chapter 18: EVelution Energy Secures Global Interest in Cobalt Project Backed by EXIM Bank

In Chapter 18 of the Michael Gibson interview series with EVelution Energy concludes with a powerful look at the project’s financing structure.

Gil Michel-Garcia shared that, in addition to the $200M support letter from the U.S. EXIM Bank, the project has attracted interest from some of the world’s largest investors.

“BlackRock, Texas Teachers Fund, Stellantis, and Mitsubishi are already in our data room looking to invest,” said Gil Michel-Garcia, Executive Vice President of EVelution Energy.

This mix of government-backed financing and private equity interest sets EVelution Energy apart from traditional EB-5 offerings in commercial real estate. Investors benefit from:

Strong job creation well above EB-5 requirements

Reduced risk profile through guaranteed supply and sales contracts

Alignment with U.S. strategic national interests

For EB-5 investors, this represents a rare chance to participate in a project that is both profitable and impactful. This chapter concludes our interview series with the EVelution Energy team. In the next phase, we will feature conversations with Intermestic Capital, the EB-5 partner helping bring this transformative project to life. Stay tuned.”

Evelution Energy Interview Chapter 18

Michael Gibson, USAdvisors, interviews Navaid Alam, President & CEO of EVelution Energy, Gil Michel-Garcia, General counsel & EVP

Transcript

Evelution Energy Interview Chapter 18 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Navaid Alam, President & Chief Executive Officer

Gil Michel-Garcia, Executive Vice President, General Counsel, Treasurer & Secretary

Michael Gibson, speaking

And, and in terms of the other components for the financing, we mentioned the 200 million from the EXIM, which should cover about 60% 70% of the cost. The other components, obviously there's an EB five component. We'll discuss shortly with the Intermestic Group. You also are bringing in some developer equity, as I understand.

Gil Michel-Garcia, speaking

Absolutely. So we've contributed it, a substantial amount of the remaining equity. And we have large equity partners, that are basically already in our data room looking to invest. So Blackrock is taking a look at our data room. The Texas Teachers Fund is taking a look at our data room. Players like Stalantis are looking at us. Mitsubishi are looking at us. And there's the, the strategic importance of this unique facility is such that major players are interested in taking a piece of, a piece of it.

Michael Gibson, speaking

Yeah I, I, I mean from my vantage point, I think again, as I mentioned earlier, we learned a big lesson during covid. Exporting all of our manufacturing capability, especially when it's in the national interest, probably is not a good idea. I think we can all agree on that. The fact that you guys are taking a proven technology, you're, you're making it greener. You're taking advantage of all these incentives that are being offered to do exactly what you're doing. Which is bring America, you know, it's manufacturing base back again. To me, makes a whole lot of sense. And then, and by being the first in the market with this product and this process to me, as, as you've already both have, makes good sense for the buyers. Because they need your product. They probably need more than you can produce. Which is a great situation for any manufacturer to be in. So, I think we learned our lessons and I think applying those, into a facility such as yours, is gonna be of great interest. Not only to the private equity investors, but, obviously, I think, to the EV5 investors. Who are looking for something different than your typical commercial real estate construction. Which is offering, you know, very low kind of yields. And, and perhaps maybe a bit more risk. Than even though, when I think of commodities market, I think of risk because of the volatility. But if you have a way to lock that in both on the buy side and the sell side I think, I think, you're, you've got a, a great strategy for for moving this forward. Well guys I, I want to thank you both again. To Navaid and Gil thank you very much for spending time. I know we'll have many more announcements, and updates that we'd like to share with our viewers. But if you're interested, at all, in this offering, or what they're doing, I'm gonna encourage you to contact us at US Advisors or Intermesic Capital. They'll be able to provide you with much more information, detailed subscription offering documents and more. So from Phoenix, beautiful Phoenix Arizona, I'm glad we're doing this in the winter and not in the summer. I wanna thank you all for joining us today, and we wish you all the best in the future. Thank you.

Gil Michel-Garcia, speaking

Thanks, Mike.

Navaid Alam, speaking

Thanks so much.

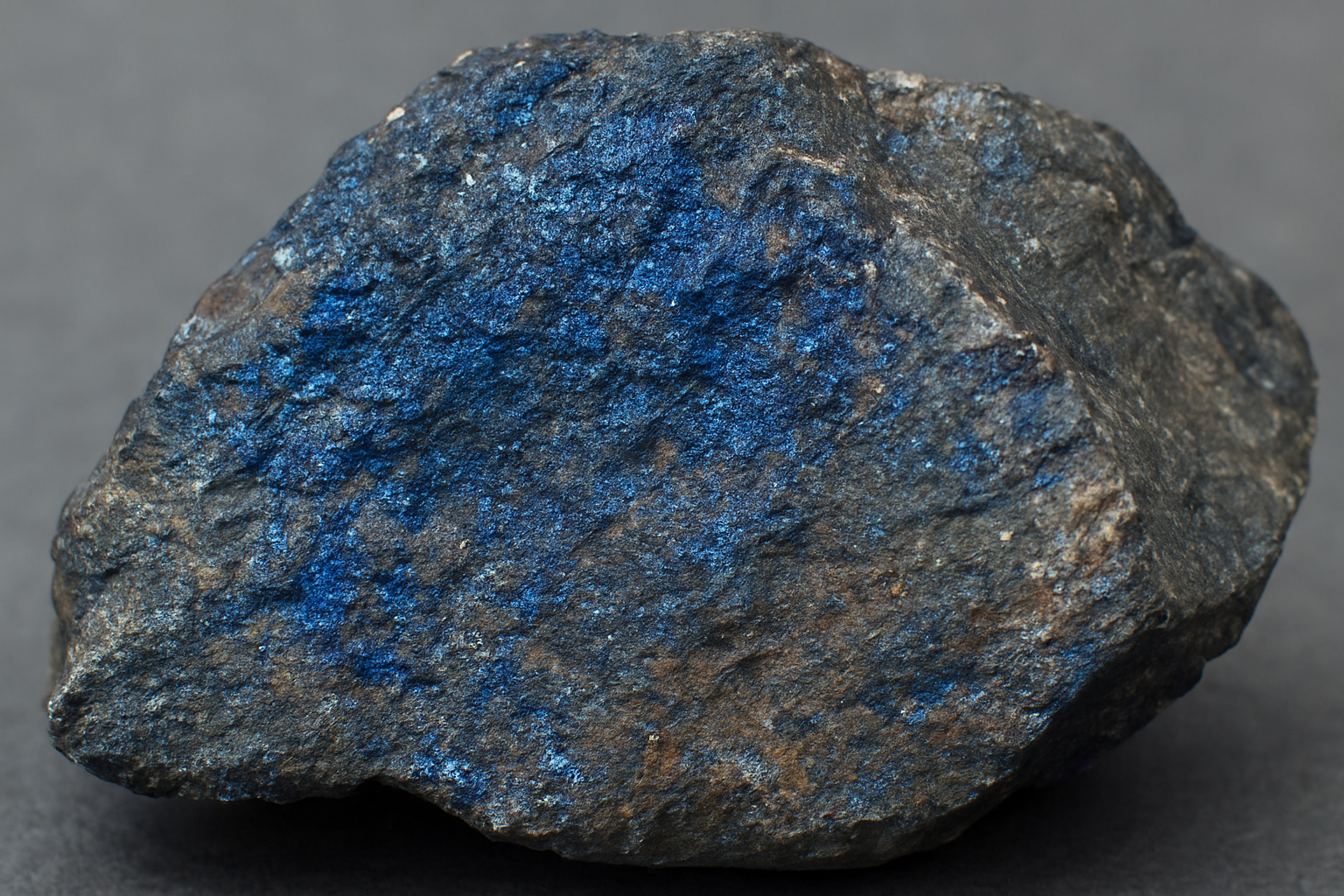

Chapter 17: EVelution Energy on Track to Supply 20% of U.S. Cobalt Demand by 2027

In Chapter 17 of Michael Gibson’s ongoing interview series with EVelution Energy, CEO Navaid Alam outlined the massive role the company’s Yuma, Arizona, cobalt facility will play in strengthening America’s EV supply chain.

With U.S. cobalt demand projected to grow 25 – 35% annually, reaching 35,000 tons per year by 2027, EVelution Energy expects to supply 7,000 tons annually — approximately 20% of U.S. demand.

“We expect to produce 7,000 tons a year, which is about 20% of the U.S. market — and we might be the only producer up and running in 2027.”

– Navaid Alam, President & CEO, EVelution Energy

Construction is slated to begin in Q4 2025, with production starting in Q4 2027 after a two-year build cycle. If successful, EVelution Energy could be America’s only cobalt producer at scale, providing a secure domestic source of this critical mineral.

Evelution Energy Interview Chapter 17

Michael Gibson, USAdvisors, interviews Navaid Alam, President & CEO of EVelution Energy,

Transcript

Evelution Energy Interview Chapter 17 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Navaid Alam, President & Chief Executive Officer

Gil Michel-Garcia, Executive Vice President, General Counsel, Treasurer & Secretary

Michael Gibson, speaking

So, Navaid just to give a sense for, how big is this plant? How much will you be producing? How much does the United States need? Just so we can get a sense. Because, I understand, we're talking about a phase 1 operation. You may be doing some things in the future with a phase 2. But for now, for this current production cycle, what are you looking to produce per year? How much is the, the, the US demand in the market? So, how much are you producing? How much is needed? And then how much do you think you'll be able to produce, may be in the future? As well as, how much is that market growing? Or is it stable?

Navaid Alam, speaking

So the market is growing annually, approximately between 25% and 35% a year. And we expect to produce, in contained cobalt terms, 7,000 tons a year. And the market, at the time we start production, is expected to be up 35,000 tons a year, in the United States. So that's about 20% of the US market. We will be able to produce.

Michael Gibson, speaking

So there's, there's a 5X demand, more demand than, than you can produce.

Navaid Alam, speaking

Right.

Michael Gibson, speaking

Yeah.

Navaid Alam, speaking

And we might be the only producer up and running in 2027, which is when we expect to be running.

Michael Gibson, speaking

We should say that there probably, I mean with this kind of a margin, and this kind of a demand in the United States, there's probably gonna be some other people coming online. But do you think in terms of your business plan, and where you're located, you may have some competitive advantages? Should other people come online.

Navaid Alam, speaking

Yeah, absolutely. We, we only know of one other cobalt facility in the United States, that might be coming online. And that's in Missouri. And they may only produce 2,000 tons of cobalt annually, contained cobalt annually. And we're producing 7,000 tons.

Michael Gibson, speaking

So you're, you're already at a much higher level than they are.

Navaid Alam, speaking

Yeah, much higher level. And as I mentioned, the North American demand would only be about 30, would be 35,000 tons. And current supply is looking to be only 9,000 tons. So, there's significantly more demand than supply coming online.

Michael Gibson, speaking

Well I, I, I wanna end it here. Although I know there's, we, we plan to do a site visit. You, when do you think you'll begin? I know you're doing some site prep now, you're drilling some wells, you're doing some other things at the site. When do you think construction, in earnest, will begin?

Navaid Alam, speaking

We expect construction to start, at the end of 2025, 4, Q4 2025 . It's a two year construction cycle. So we expect to be producing in Q4 2027.

Chapter 16: Evelution Energy’s Secured Contracts and U.S. Tax Credit Drive Strong Margins

In Chapter 16 of our ongoing interview series, Michael Gibson of USAdvisors.org speaks with Gil Michel-Garcia, Executive Vice President, General Counsel, Treasurer & Secretary of Evelution Energy.

Gil shares how Evelution has already signed input contracts for cobalt hydroxide while aligning both input and output pricing to the same global metal index. This strategy ensures defensible margins regardless of commodity price volatility.

He also highlights the U.S. government’s Critical Minerals Production Tax Credit, which adds an additional 10% annual cost savings. Combined, these measures boost EBITDA margins from an industry-standard 10–15% to an impressive 20–25%.

“That’s huge for a processing facility. And again, hence why this project is economically viable. It’s a home run type of project.” — Gil Michel-Garcia

This chapter underscores why Evelution Energy’s Yuma cobalt processing facility is poised for long-term profitability and represents a unique opportunity for EB-5 investors.

Evelution Energy Interview Chapter 156

Michael Gibson, USAdvisors, interviews Gil Michel-Garcia, EVP & General Counsel of EVelution Energy,

Transcript

Evelution Energy Interview Chapter 16 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Navaid Alam, President & Chief Executive Officer

Gil Michel-Garcia, Executive Vice President, General Counsel, Treasurer & Secretary

Michael Gibson, speaking

And, and, and you refer to that as your outtake, your offtake.

Navaid Alam, speaking

Offtake.

Michael Gibson, speaking

Your offtake. So everything that you produce is your offtake. And then to hedge your import that, the hydroxide from Africa. That is also your, your negotiating contracts for that, so that you can have your, your inputs fixed. And then your output also fixed. So you have, you, you should be able to maintain that, that level of margin.

Gil Michel-Garcia, speaking

Those import contracts are already signed. So the import stuff is already negotiated and signed. We are buying, because we have commodity experience, we're buying the hydroxide priced off of the metal index. And then we're selling the sulfate and the metal priced off the metal index. So we're buying on, off of the same index that we're selling. And that allows us to be able to structure, not exact margins, but very defensible margins, irrespective of what the price does. It doesn't matter what the price does, we will have a band that will be able to...

Michael Gibson, speaking

And just, and you would say, you both, gentlemen have experience in other industries. You say that, that's a healthy margin?

Gil Michel-Garcia, speaking

Well, yeah. I mean they, they, they, just to give you kind of an indication, a general the, one of, some of the best processing facilities in the world would normally have 10 to 15% EBITDA margins. We're gonna benefit from that, being a top of the line class facility. On top of it there is a production tax credit, it's called the Critical Minerals Production Tax Credit. Which is being offered by the, by the, by the US government, for production of critical minerals specifically.

Michael Gibson, speaking

Perfect, yeah.

Gil Michel-Garcia, speaking

Right, which gives us back about 10% of our cost of goods on an annual basis. That jumps our EBITDA margin from a 10% to 15% EBITDA margin. To about a 20% to 25% EBITDA margin.

Michael Gibson, speaking

Yeah, that's...

Gil Michel-Garcia, speaking

That's huge for processing facility. And again, hence why the, this economic, this project is economically viable. Hence, why we're offering so much to investors to participate. Because it is a really it's a home run type of project.

Michael Gibson, speaking

You've already got that kind of baked in once, once the plan is operational. It's alright, you've already got the, the product being sold. And you've got the, the contracts for purchasing the input. So...

Chapter 15: EVelution Energy Secures Long-Term Agreements with GM, Stellantis & Mitsui

In this chapter of our ongoing interview series, Michael Gibson (Managing Director, USAdvisors.org) speaks with EVelution Energy’s CEO, Navaid Alam, about the company’s offtake agreements and financial outlook.

Navaid highlights that on day one of operations, EVelution Energy expects to be profitable, with production already sold under long-term contracts to major global companies such as General Motors, Stellantis, and Mitsui.

“We expect to be profitable from day one… everything that we are producing is already going to be sold to huge, creditworthy counterparties like General Motors, Stellantis, and Mitsui.” — Navaid Alam, CEO, EVelution Energy

This milestone underscores the project’s financial strength, proven technology, and critical role in reshaping America’s electric vehicle supply chain.

Evelution Energy Interview Chapter 15

Michael Gibson, USAdvisors, interviews Navaid Alam, President & CEO of EVelution Energy,

Transcript

Evelution Energy Interview Chapter 15 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Navaid Alam, President & Chief Executive Officer

Gil Michel-Garcia, Executive Vice President, General Counsel, Treasurer & Secretary

Michael Gibson, speaking

So using approved technology, again nothing brand new, nothing innovative. This is established technology used around the world. You're just coming in with, I would call it a greener approach. Which obviously also makes financial sense if, if you're getting all this renewable power in Yuma Arizona. So using that technology, a fast build out, two years to stabilize. Navaid, we had the conversation earlier. And, and you said on day one, you're guaranteed pretty much, I mean to the extent that guarantees can be made in, in a world of some volatility. But essentially on day one, everything that you are producing is already gonna be sold.

Navaid Alam, speaking

That's right. And it'll be sold to huge, credit worthy counterparties, like General Motors, Stellantis, Mitsui. Companies that have, you know, very stellar credit ratings. And we expect to sign, long term contracts with them. That are say five year contracts with, you know, the pricing will be fixed annually.

Michael Gibson, speaking

Sure.

Navaid Alam, speaking

So, we expect to be profitable from day one. This, this market is, it's a single commodity of inputs. And our outputs are priced off of the same metal index. And off of the same month. So our basis risk is, is going to be hedged down, as much as we can possibly get it down. And then we'll, we should be worth, you know, well in excess of our construction cost. And, and all the EB5 financing as soon as we start producing.

Chapter 14: EVelution Energy Secures EXIM Bank Backing: $200M LOI with Unmatched Terms

Gil Michel-Garcia, EVP & General Counsel of EVelution Energy, reveals a major milestone in the financing of their Yuma County cobalt processing facility.

In Chapter 14, Gil Michel-Garcia and Michael Gibson discuss that the U.S. Export-Import Bank (EXIM) has issued a Letter of Intent for up to $200 million, covering 70% of construction costs. The terms are extraordinarily favorable—18-year financing at rates around 5-5.5%—demonstrating federal commitment to reshoring critical mineral supply chains and reducing reliance on China.

These financing terms are virtually unheard of in private markets. They provide EVelution Energy with the stability to build and operate the facility while keeping EB-5 capital requirements modest and well-secured.

For EB-5 investors, this means participating in a project with government-backed financial strength, accelerated revenue generation, and an investment structure designed for security and long-term success.

Evelution Energy Interview Chapter 14

Michael Gibson, USAdvisors, interviews Gil Michel-Garcia, EVP & General Counsel of EVelution Energy,

Transcript

Evelution Energy Interview Chapter 14 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Navaid Alam, President & Chief Executive Officer

Gil Michel-Garcia, Executive Vice President, General Counsel, Treasurer & Secretary

Michael Gibson, speaking

So, the second most important question, after the job creation, which ensures that the green card conditions are met. Let's talk about the capital stack. Let's talk about how could the investors, if they decide to invest in this. We've shown the demand for the cobalt sulfate in the United States. Shortening the supply chain sounds like a great idea. How are you gonna finance this? What does the capital stack look like? I understand you, Gil you were saying, you have you've already secured external financing. So how did, for the viewers who may be curious to know? How much is EB5? How much is non EB5? How much are you contributing? How does that look?

Gil Michel-Garcia, speaking

So, one of the most important facets of creating a project or building a project that is in the national interest of the United States, is the fact that the government is very willing to step in and provide us with, I wouldn't say subsidized, but extremely attractive financing. On much longer terms that would otherwise be available. Let's say in a real estate deal. So for us the, there are two programs that we've been able to benefit from. One's called the Make More In America program. And that's the EXIM Bank, Make More In America program. And the make more, and the China Transformational Exports program of the EXIM Bank. Both of those programs, started by President Trump during his first administration, are focused at financing businesses that in the critical mineral, and other transformational areas like chips, that compete against China. And so, we've been able to secure an LOI from the EXIM Bank already, for 70% of the cost of constructing the facility, which is up to $200 million.

Michael Gibson, speaking

Right.

Gil Michel-Garcia, speaking

That's really attractive financing, it's 18 year term financing, construction financing. That is at very low rates, probably in the vicinity of 5%, 5.5%.

Michael Gibson, speaking

Which is unheard of in commercial. For all the commercial real estate developers, who are wondering how can they get a hold of that? I think the answer is build a manufacturing plant

Gil Michel-Garcia, speaking

That focuses on something that...

Michael Gibson, speaking

Exactly, forget about the multi family. That's not gonna work.

Gil Michel-Garcia, speaking

So, that allows us to raise a smaller component through EB5. And it also allows us to be able to be sure that we will have the financing to pay for the EB5, in the short term. Our construction period is quite short. Because we're not reinventing the wheel, we're building, if you like the, the, the lowest hanging fruit, of the most necessary facilities, in the United States. It's gonna take no more than two years to build. And we already have the, almost all of the off take in negotiations. I mean almost 80% of our off take is already spoken for in negotiations with off takers. So essentially as soon as we start operations the revenue is gonna be coming in quite quickly. And we only produce one thing.

Michael Gibson, speaking

Right.

Chapter 12: EVelution Energy Project Economic Impact to Create 3,000+ Jobs in Yuma County

CEO Navaid Alam highlights how the cobalt processing facility will create both high-paying local jobs and a surplus of EB-5 qualifying employment.

In Chapter 13 of our exclusive interview series, Michael Gibson of USAdvisors.org speaks with Navaid Alam, President & CEO of EVelution Energy.

Navaid explains that a Baker Tilly economic study projects more than 3,000 jobs will be created in Yuma County through the project — including direct, indirect, and induced employment.

Of these, approximately 80 jobs will be plant operations roles, paying about three times the local average wage. To further strengthen the community, EVelution Energy has partnered with Arizona Western College to provide customized workforce training programs.

This commitment to job creation not only ensures a lasting local impact but also significantly exceeds EB-5 program requirements. With only about 30% of eligible jobs needed for EB-5 compliance, the project demonstrates both strength and stability for investors.

Evelution Energy Interview Chapter 13

Michael Gibson, USAdvisors, interviews Navid Alam, CEO & President, EVelution Energy

Transcript

Evelution Energy Interview Chapter 13 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Navaid Alam, President & Chief Executive Officer

Gil Michel-Garcia, Executive Vice President, General Counsel, Treasurer & Secretary

Michael Gibson, speaking

So let's, let's, one of the big concerns, obviously, job creation is a big concern in the EB5 space. And we'll be having an interview with Intermestic, who's the fund manager, to discuss the EB5 components. But, in terms of the plant operation, how many people do you foresee needing operationally, to run it. And then, you know, how many, how much will you be investing in order to make the plant operational through construction and other activities.

Navaid Alam, speaking

So, we've had a, a study done by Baker Tilly that has shown that we'll create a in direct, indirect, and other jobs of over 3,000 jobs will be created through our project in, in Yuma County. Our plant operations themselves will be about 80 jobs. High paying jobs for the area. We'll be averaging maybe three times the, the local wage. So,

Michael Gibson, speaking

So it's a great job for, for somebody in the county.

Navaid Alam, speaking

Yeah, it's a great benefit to the county. And our you know, workforce training programs are already underway with Arizona Western College. So they're partnering up with us as well to create training programs at their campuses in Yuma County, for, or our, local work, workforce as well. And so, in terms of job creation, we are, you know, creating a huge over supply under the EB5 program. We're, we're, we're only gonna be using about 30% of the jobs that we qualify for, for the EB5.

Chapter 12: Evolution Energy: Delivering Clean Power and Community Benefits

Gil Michel-Garcia explains how the project lowers costs for local farmers while protecting EB5 Investor margins.

In Chapter 12 of our exclusive interview series, Michael Gibson speaks with Gil Michel-Garcia, Executive Vice President of EVelution Energy, about the project’s unique commitment to both sustainability and community well-being.

As water levels in the Colorado River decline, local farmers have faced rising electricity costs. EVelution Energy is stepping up by offering its excess renewable power to the community at half the price of current market rates. This ensures farmers can remain competitive while reinforcing the project’s role as a trusted partner in regional development.

At the same time, Gil explains how EVelution Energy has already secured long-term power purchase agreements that provide stable operating margins, protecting investors from commodity market volatility.

This chapter showcases how EVelution Energy is not only profitable but also a force for local good, making it a standout EB-5 investment opportunity.

Evelution Energy Interview Chapter 12

Michael Gibson, USAdvisors, interviews Gil Michel-Garcia, Executive Vice President & General Counsel, EVelution Energy

Transcript

Evelution Energy Interview Chapter 12 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Navaid Alam, President & Chief Executive Officer

Gil Michel-Garcia, Executive Vice President, General Counsel, Treasurer & Secretary

Michael Gibson, speaking

And, and, obviously much greener, better for the environment, and for the long term. And, and the residents are loving this, because there's no emission.

Gil Michel-Garcia, speaking

Well, I mean one of the, one of the, this is a farming area where we're basically putting the facility. And many of the farmers have traditionally been supplied with hydro power from the Colorado River. Because of the climate and the warming of the planet that has decreased water. And so water, less water has means less hydro power. Less application of power to them. They've been having to go to the open market to buy electricity. Which then triples their electricity cost.

Michael Gibson, speaking

Sure.

Gil Michel-Garcia, speaking

Something like 12 or 15 cents a kilowatt hour. One of the ways in which we've been able to garner enormous support from the local community is to offer to resell our excess power to the local community. Supplying them with power at half the price that they're normally.

Michael Gibson, speaking

Right, so not only are you not competing with them for the kilowatts. You know, which they're gonna want as well as the county grows. But you're gonna be able to supply them some of your excess energy.

Gil Michel-Garcia, speaking

And one of the important things when, when, when your investors think about this, is that because we have guaranteed supply that we've already signed. And we're already in advanced negotiations with the off take. We're buying and selling something at pre negotiated prices. Because, it, it's not like a mining operation where we're depending on the commodity price. What we're negotiating is pretty protectable operating margins, on the buy and the sell. And so what that means is that we, as a project, have relatively steady and protected margins and operations. Which is one of the reasons why, not only we're gonna be very profitable, we're gonna be successful. But we'd also offer some of that profitability to investors to entice them to invest with us.

Chapter 11:De-Risking rural EB-5: How the EVelution Energy Project Redefines Investor Confidence

Marco Lopez shares why this Yuma County cobalt facility combines community backing, strong economics, and national interest to create a uniquely secure EB-5 opportunity.

In Chapter 11 of our interview series, Michael Gibson and Marco Lopez, Managing Partner at Intermestic Capital, explore the unique value proposition of EVelution Energy’s cobalt processing facility in Yuma County, Arizona.

While many rural EB-5 projects struggle with risk and financing, this one stands apart:

Economic safeguards: Input and output prices locked in through negotiated contracts.

Job creation: Over 3,300 jobs projected — far beyond EB-5 requirements.

Community support: Endorsed from U.S. Senators to the local Mayor.

National interest: Reshoring a critical industry for clean energy and national security.

As Marco explains, these elements transform what might be considered a “risky rural project” into a high-value, strategically important investment — and a model for EB-5 success.

Evelution Energy Interview Chapter 11

Michael Gibson, USAdvisors, interviews Marco Lopez, Managing Partner, Intermestic Capital

Transcript

Evelution Energy Interview Chapter 11 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson, speaking

Dennis, I'm glad you mentioned the risk. And Marco, I want to ask you. So it's interesting because when the EB5 program pivoted a few years ago after the enactment of the RIA, the Reauthorization. It was interesting to me to see now, how we went from so many metro commercial real estate projects. Large developments, New York City, LA, Miami. We must have had three dozen projects going on at this, at the time. To now seeing a shift much more to the rural. Because of the processing times and the priority that's given to them. But my concern is as an investment advisor, I see a lot of these rural projects, and I see a huge amount of risk. I and, and I for, it's for a good reason, that they have a hard time obtaining the capital. Because of the, the just the, the risk profile of the enterprise. You may have these resorts we've, we've seen experience with past EB5 projects, who were located in rural locations and had a disastrous result. But it was so enlightening to hear from the principles of the EV cobalt processing plant. How they have the profit margins. And how they have locked in the sale that, you know not only their input price, but they're at output. So, Marco, tell us, for the viewers who may not be as familiar with the with the risk profile or with the monetary outlook for this. What is it interesting for you? What is attractive about this project from an investor standpoint?

Marco Lopez, speaking

Well, when we started our conversation, I talked about being someone born and raised on the border. And Yuma County is one of our county, our border counties with Mexico. And so that to me was an appealing factor because you're bringing a community a great value. I think Gil talked about from an energy perspective, from a water perspective, from a job safety and security perspective, And the right, the reason why the community embraces this project. All the way from our US Senators down to the Mayor. Because they understand the value and the importance that you're bringing from an economic development standpoint. And so the task in our EB 5 work is, are you going to fulfill and meet the job demand that the project requires.

Michael Gibson, speaking

Outlined in the Business Plan.

Marco Lopez, speaking

Right. So are you going to be able to match 10 per investor? And here unequivocally, the answer is absolutely. Are you going to be able to provide the economic viability of the project? And here, again, because of the safeguards that Gil and Navaid, and the team have a negotiated, and already contracted, the answer is unequivocally absolutely. And so, that was part of the selection criteria for our firm. Is, if we were going to pursue this opportunity? And, and what was the most appealing, I think, Dennis mentioned, and you mentioned it. Arizona is full of developers in shopping centers, housing, you name it. You can't toss a cat and not hit a real estate agent or a commercial real estate agent.

Michael Gibson, speaking

Yes.

Marco Lopez, speaking

And so that's not appealing or exciting. We would have rejected, and we’ve rejected those types of offerings, here because there's nothing unique here. You add the layer of the national interest, the opportunity to bring and re-home an industry that's vital for national defense and national security to America. And then all the pieces start lining up. And that risk becomes de-risked.

Michael Gibson, speaking

Yeah, and, and what, what fascinates me about Intermesic is that, I mean, even though this is your first EB 5 project, you, you are a capital firm. You, you focus on risk, you focus on how does the investor do well in, in investing in other projects that you may be associated with. So you, from what I understand, you’re taking the same philosophy, of trying to find projects that make good sense economically. And now you’re bringing it to an EB5 component. So we have the job creation component. But then in addition, you want to make sure that the project makes sense economically.

Marco Lopez, speaking

That’s right. So look, in this particular case we know that the job, that the project is going to create over 3300 jobs. And we’re not, we’re not going to need all those jobs. To just…

Chapter 10: Inside the 10%: Why This EB-5 Project Passes the Test and Stands Apart

EB-5 veteran Dennis Cunningham explains why the EVelution Energy cobalt facility is a rare, high-impact, and strategically important investment opportunity.

In Chapter 10 of our exclusive interview series, Michael Gibson speaks with Dennis Cunningham, President of EB5 Horizon and Operating Partner at Intermestic Capital, about what it really takes for an EB-5 project to qualify.

Dennis shares that for every EB-5-eligible project, there are 10–20 that simply don’t meet the requirements — often because they aren’t shovel-ready or lack the right partners.

What makes the EVelution Energy cobalt processing facility different?

Strategic importance: Critical to U.S. clean energy and electric vehicle supply chain initiatives.

Shovel-ready: Years of preparation by experienced developers have brought the project to launch.

Risk protection: A stronger profile than many traditional commercial or real estate projects.

“This project brings together talented, committed partners at exactly the right time,” Dennis says. “It’s exciting to be part of something that truly matters on a national scale.”

Watch Chapter 10 now and see why this opportunity stands out in the EB-5 marketplace.

Evelution Energy Interview Chapter 9

Michael Gibson, USAdvisors, interviews Dennis Cunningham, Operating Partner, Intermestic Capital & Pressident EB5 Horizon

Transcript

Evelution Energy Interview Chapter 10 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson, speaking

Dennis, you've been, you've been in the EB5 program since 2010. You have a lot of experience. I mean, do you see what I'm saying? As far as, 90% of the projects are, you know, what I would call just not relevant. Not relevant to the national conversation. This project is exciting because it is so important and it's rare. But it's rare. Why? Why do you think that is? And can you talk about how excited you are to see something like this in the market?

Dennis Cunningham, speaking

Thanks, Mike. I first heard about EB 5 in 2009. And got actively involved in 2010. It's hard to qualify for an EB 5 project, From the project sponsor side. For every project that is interesting, I look at 10 or 15. I’m sure Sergio and Marco would say the same thing. We look at 10 or 15 or 20 projects that don't qualify, for a number of reasons. So people, developers, sponsors, EB 5 experts find a model that works and they want to stay with it, Cause it's messy. I've invented the cookie, I just want to keep doing it. What is exciting about this is you’ve got people who are so talented and committed, like Navaid and Gil are for the EV project, and have spent years to bring it to this point! The other problem that's hard with EB 5, is the project’s got to be almost shovel ready. Sergio talked about access, right? We were fortunate to find access with these two great, great guys, and this great project at the right time! If they would have talked to us two years ago, we would have said, sorry. We can't help you, cause you weren't far enough of down, down the line. It's exciting be part of a project that is critical for the development strategic initiatives of the United States. And it is something that is in a space that is more risk protected, than maybe the typical, commercial development or real estate development. For, for those things, I, I, I really like this project.

Chapter 9: National Access, Global Impact: Intermestic Capital on What Sets EVelution Energy Apart in EB-5

In this latest chapter of our exclusive interview series, Intermestic Capital Operating Partner Sergio Chavez-Moreno shares what makes the EVelution Energy cobalt processing project uniquely positioned to serve national interests — and why Intermestic’s global access sets their EB-5 strategy apart.

Chapter 9 of the ongoing EVelution Energy interview series with Michael Gibson, Managing Director of USAdvisors.org, features Sergio Chavez-Moreno, Operating Partner at Intermestic Capital. In this candid conversation, Sergio highlights a rarely discussed truth in EB-5 investing: most firms don’t have the access or insight needed to source projects that truly serve national strategic interests.

Unlike typical real estate or hotel developments, the EVelution Energy project addresses critical gaps in the U.S. supply chain by bringing cobalt processing—a vital component for batteries and defense manufacturing—back to American soil. Sergio explains that what made this project possible wasn’t luck; it was Intermestic’s deliberate cultivation of relationships across sovereign capitals and national leadership circles.

Their unique positioning allowed them to source a best-in-class investment that not only creates jobs but contributes to the nation’s industrial base, energy independence, and global competitiveness.

As Sergio puts it, “It all comes down to access—and that’s where Intermestic has the edge.”

Evelution Energy Interview Chapter 9

Michael Gibson, USAdvisors, interviews Sergio Chavex-Moreno, Operating Partner, Intermestic Capital

Transcript

Evelution Energy Interview Chapter 9

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson, speaking

So Sergio, it is curious to me, and you're an attorney, why more people in the EB 5 space, are not doing projects, which do help, to, in a fundamental way the national interest. They I, we see a lot of hotel projects, and a lot of commercial real estate, of that nature. But it's very rare to see something like this. Which could actually end up helping promote US industry, manufacturing, our GDP. Because a lot of what, may be manufactured, could be even exported. So it's curious to me why we don't, why do you think is it, we don't see more of these projects? And to that point, why does this make your project so special?

Sergio Chavez-Moreno, speaking

Well, thank you, Michael. First and foremost, because a lot of other firms lack Intermestic’s access. In order to source a quality project like we did, that best in class and serves a national interest, you, you have to have access to those circles. Right? And that is something that we've been very fortunate to have with Marco. Access. Right, exposure to what's going on, on the national level, international level. So, it all comes down to exposure and access. And I would say that is an area where Intermestic really has that advantage, right? We make our business to be in the conversation in, well, in most the most sovereign capitals.

Michael Gibson, speaking

Yeah, no, I, and I like that. It's

Chapter 8: Intermestic Capital’s Strategic Approach to EB-5, National Security & U.S. Manufacturing

In this latest chapter of the interview series hosted by Michael Gibson, Marco Lopez of Intermestic Capital shares how national security, economic resilience, and job creation are at the center of their approach to EB-5 investing. With a focus on reshoring critical industries, Intermestic’s collaboration on the EVelution Energy cobalt facility demonstrates how immigration investment can strengthen both America’s workforce and strategic infrastructure.

In Chapter 8 of our ongoing interview series with Michael Gibson of USAdvisors.org, we hear from Marco Lopez, Managing Partner at Intermestic Capital, who shares how his team is reshaping the EB-5 investment landscape through a unique focus on national security and domestic manufacturing.

During the conversation, Marco discusses the growing importance of shortening supply chains—a lesson reinforced during the pandemic and increasingly relevant in today’s volatile global environment. Intermestic Capital has strategically shifted its focus to projects that support reshoring American manufacturing, particularly in sectors critical to national interest.

The Yuma, Arizona-based EVelution Energy cobalt processing project is one such example. This facility not only helps reduce America’s reliance on foreign supply chains but also qualifies as a High Unemployment Targeted Employment Area (TEA)—making it ideal for EB-5 investors looking to contribute to real U.S. job creation.

Marco emphasizes the value of government experience and policy insight when navigating the EB-5 space.

“Understanding how federal agencies and Congress operate gives us a distinct advantage in executing projects that serve both investors and U.S. economic goals,” he said.

Watch the full interview here to learn how Intermestic Capital is aligning immigration investment with America’s industrial future.

Evelution Energy Interview Chapter 8

Michael Gibson, USAdvisors, interviews Marco Lopez, Managing Partner, Intermestic Capital

Transcript

Evelution Energy Interview Chapter 8

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Michael Gibson, speaking

Right, what we, we mentioned in the other video, with the principles was shortening the supply chain.

Marco Lopez, speaking

Correct.

Michael Gibson, speaking

And, and we talked about how crucial it was, not only during Covid, but in times of, well, we're in a very unstable world, to a lot of volatility. So the, the closer that the manufacturers have, and manufacturing is now taking a lot of priority and importance back in the country. So shortening that supply chain so that the US manufacturers can deliver as what they're promising their shareholders, seems to be much more important.

Marco Lopez, speaking

Yeah. And so that's what we really focused, and I moved the direction of the firm to think about and work with organizations and companies that were doing the work of coming back to America. And, and, and reshoring those companies. Manufacturing especially, to shorten those supply chains, as you mentioned. And so, when the latest reform to the EB 5 space occurred, under the previous term of President Trump, Sergio here, here brought to the table, the opportunity to both, that align with our interest at Intermestic. Which was creating quality jobs here in our State, and here in America. With the ability to practice our international trade. Which was find a, a unique offering and opportunity for our network of international investors. That were seeking to come to America and invest in job creating spaces in our State. And so it just happened to be a perfect match. And then we set out on the work with Sergio, and with Dennis to find a premier project that fit that, those priorities. But in this case also elevated it to my background of national interest, national security. Finding an opportunity that did that. And that's how our work in being the promoter sponsor of EVelution priority projects.

Michael Gibson, speaking

So, so, so even though Intermestic, may be, what we might say, is that newer player to the EB 5 space, you have a tremendous amount of experience. Working with immigration and, and with the agencies and in Congress. And, and knowing what the program is looking for in terms of job creation. And all of the other aspects of the EB 5 program promises to, not only the investors but to the US citizens.

Marco Lopez, speaking

Yeah. It really fit well. Because of in an era of uncertainty, understanding the way that the federal government works, especially around national interest and national security was key. I was frankly surprised that more experts, coming out of the administration, haven't really taken an active role in projects dealing with EB 5 and other government programs that attract foreign investors. Because that really is a, a space that is unique. And you have to figure out and know the inner workings, the sausage making that you talked about, so that you could get ahead and you could be successful. And that's what we hope to accomplish with this project in Yuma.

Chapter 7 – Behind the Project: Intermestic Capital’s Vision for EB-5 and U.S. Economic Growth

How Marco Lopez, Sergio Chavez-Moreno, and Dennis Cunningham are reshaping investment-driven development with the EVelution Energy cobalt facility

In Chapter 7 of the EVelution Energy interview series, Michael Gibson welcomes the leadership team behind Intermestic Capital: Marco Lopez, Sergio Chavez-Moreno, and Dennis Cunningham. Together, they break down the thinking and experience behind bringing this high-profile EB-5 project to market.

Marco Lopez shares a compelling personal and professional journey—from becoming the youngest mayor in the U.S. at age 22, to serving as Chief of Staff at U.S. Customs and Border Protection during the Obama administration. His intimate understanding of government operations has shaped Intermestic Capital’s investment strategy—bridging public policy with private development in a way that supports long-term national priorities.

“After serving in Washington, it was important to bring what I learned back to Arizona,” Lopez explains. “We wanted to find projects that created real value—jobs, clean energy, and domestic manufacturing.”

This episode explains how the EVelution Energy project aligns with the goals of reshoring critical mineral processing and offering global investors a direct stake in America’s clean energy future.

Evelution Energy Interview Chapter 7

Michael Gibson, USAdvisors, interviews Marco Lopez, Managing Partner, Intermestic Capital

Transcript

Evelution Energy Interview Chapter 7 Transcript

Michael Gibson, Managing Director of US Advisors (USAdvisors.org) an independent Registered Investment Advisory Firm. Michael also owns and runs EB-5 Investments (eb5projects.com) and is an EB5 industry expert.

Marco Lopez, Managing Partner, Intermestic Capital

Sergio Chavez-Moreno, Operating Partner Intermestic Capital

Dennis Cunningham, Operating Partner Intermestic Capital, President EB5 Horizon

Michael Gibson, speaking